Property Newsletter | July 2023

Homeowners under increased pressure as interest rates rise

150 000 homeowners paying R600m per month more to service bonds taken out in 2021

Rising interest rates, increased power costs, higher living costs and a weakening currency are combining to put consumers – and homeowners – under increased pressure.

Some Estate Agents are reporting a decline in sales and buyer enquiries coupled with an increase in properties being put on sale. Property economists say property prices and activity were negatively affected in the second quarter of 2023 as interest rate hikes began to bite and a credit report pointed to South Africa entering 2023 with a quarter-on-quarter increase in defaults and overdue balances for the first time since Covid.

The picture being painted is one of increasingly tough conditions for homeowners in South Africa, and homeowners in Britain are also facing pressure as interest rates spike: indeed media reports suggest house prices will fall by 12% from “peak-to-trough” by the end of 2024, and there is little hope for a strong recovery as “buyers will continue to face higher real costs of borrowing for the foreseeable future”.

“UK house prices will fall by 6.6% in 2023, and then by a further 4.9% next year. After that, S&P Global Ratings expects the market will stagnate, with growth of just 1.4% and 3% across 2025 and 2026 respectively.” The Telegraph, July 2023.

Elsewhere, borrowers in some European countries and the USA are protected from interest rate shocks by long-term loans.

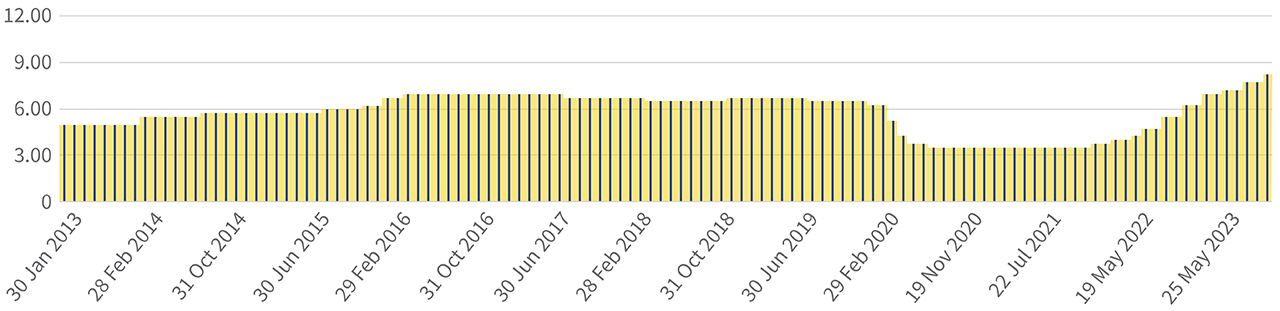

The graph below shows how the repo rate has been rising in recent months, although its full impact is yet to be felt, notwithstanding the industry comments above. The months ahead will tell how the story unfolds.

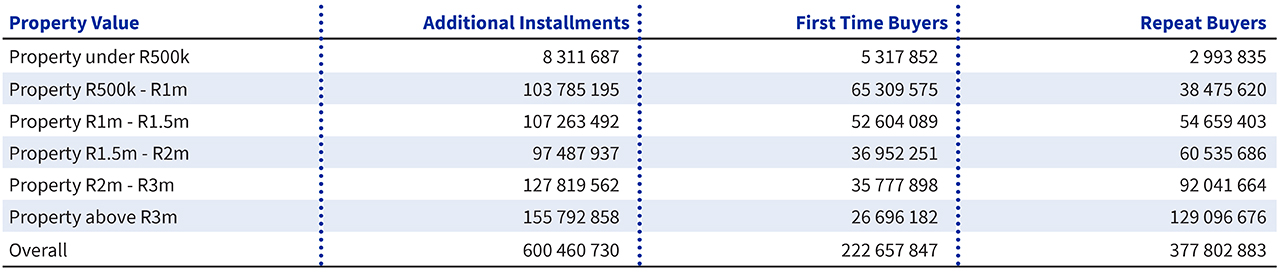

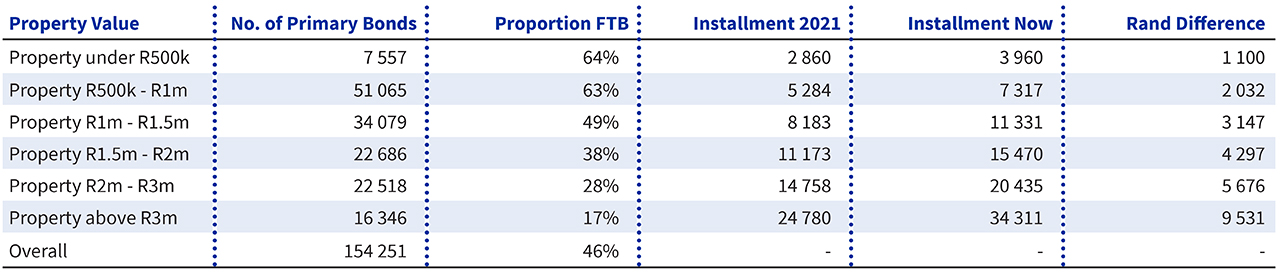

Lightstone’s analysis points out that 155 000 homeowners who bought and bonded properties in 2021 are paying collectively R600m or 40% more per month to service their instalments.

Of the 155 000 bonds issued in 2021, 46% were to first time buyers (FTBs), unsurprisingly a declining ratio from 64% for lower value properties to 17% for properties in excess of R3m.

Sectional schemes account for 27% of the increased instalments, and there are developments that will be at risk if affordability leads to defaults. Naturally, new developments are more affected as they have a greater proportion of bonded sales which took place when interest rates were low.

There are 16 schemes where more than 50% of the development’s units were bonded in 2021 (and the volume bonded in 2021 exceeds more than 50 units). This covers 2 000 bonds which translates into increased monthly instalments of R4.5m.

Examples of pressure being faced by homeowners include:

- A development in Centurion, where 405 out of 520 properties were bonded in 2021, at an average bond value of R660k. On average, bond payments went up from Bond R5 200 to R7 200 a month, which equates to homeowners combined having to find more than R800 000 a month or R10m a year.

- Homeowners at another development in Pretoria must find another R500 000 in bond payments per month or R6m a year. Of the development’s 369 units, 267 were bonded during 2021 at an average of R676 000.

- In Roodepoort, almost all units – 139 out of 144 – were bonded in 2021. This group may struggle with affordability, as instalments have soared from R3 500 a month to R4 800 a month.

.png)

.png)

.png)

.png)