Property Newsletter | February 2023

Value growth along eThekwini’s north coast

... but the south slips behind inflation and values drop in real terms

Residential property prices in KwaZulu-Natal’s eThekwini reflect the ongoing migration of wealthier buyers along the north coast and the economic and social challenges facing the central and southern areas – exacerbated in recent years by the insurrection in 2021, floods in 2022 and widely reported complaints of lack of service delivery in the metro.

eThekwini is home to around 3.5m people and is the province’s largest metro and economic driver. The metropolitan municipality was formed from seven formerly independent local councils and tribal land in 2000.

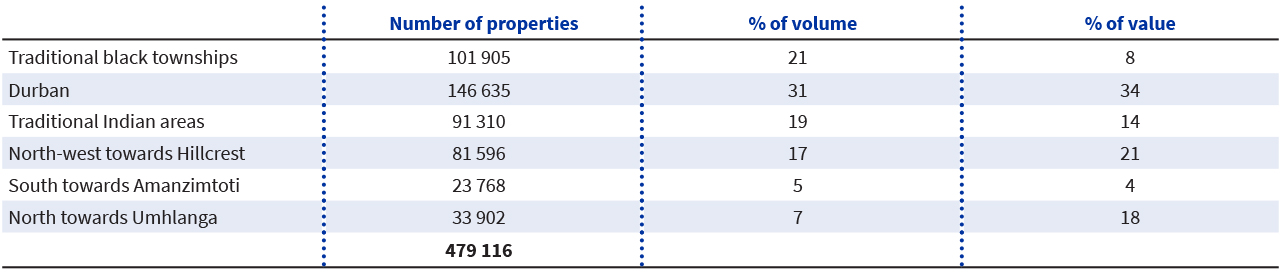

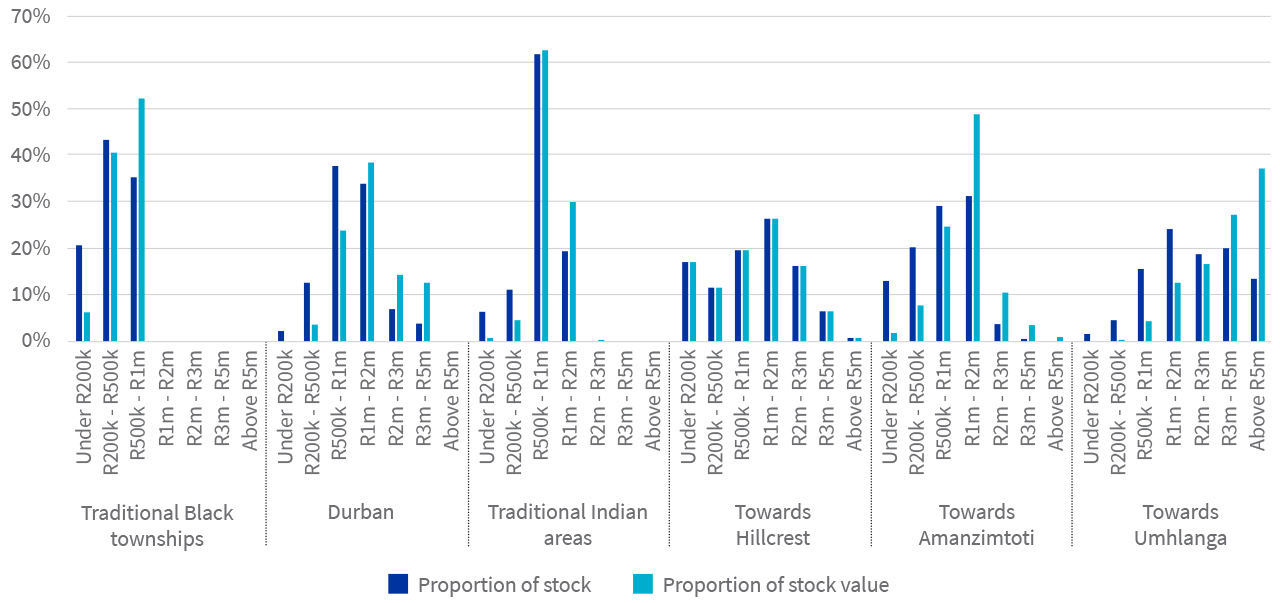

Lightstone splits the metro into four main geographic areas – the city of Durban itself, the area south of the city to Amanzimtoti and Kingsburgh, the area north-west to Hillcrest and Kloof, and the area north to Umhlanga.

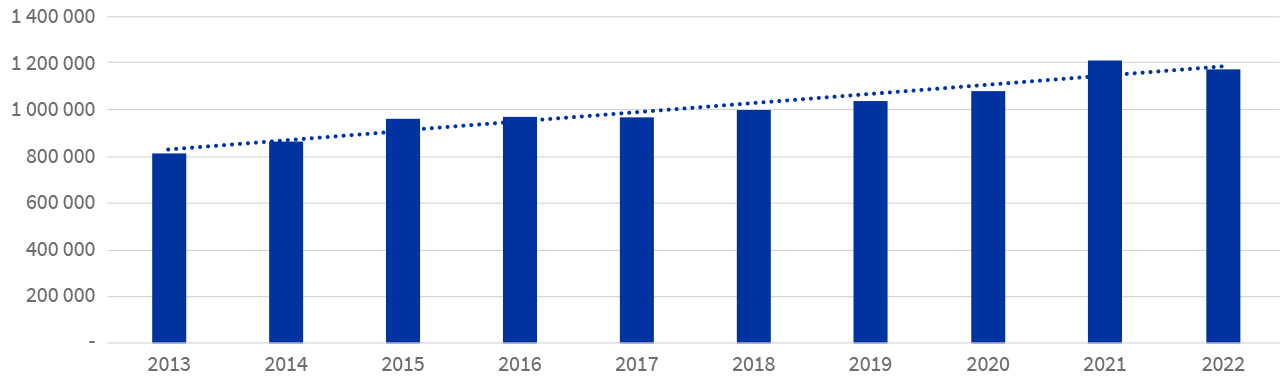

There are 480 000 residential properties in eThekwini valued at R470 billion, at an average of R1.1 million a property which is 62% up on the average value of R680 000 from 10 years ago.

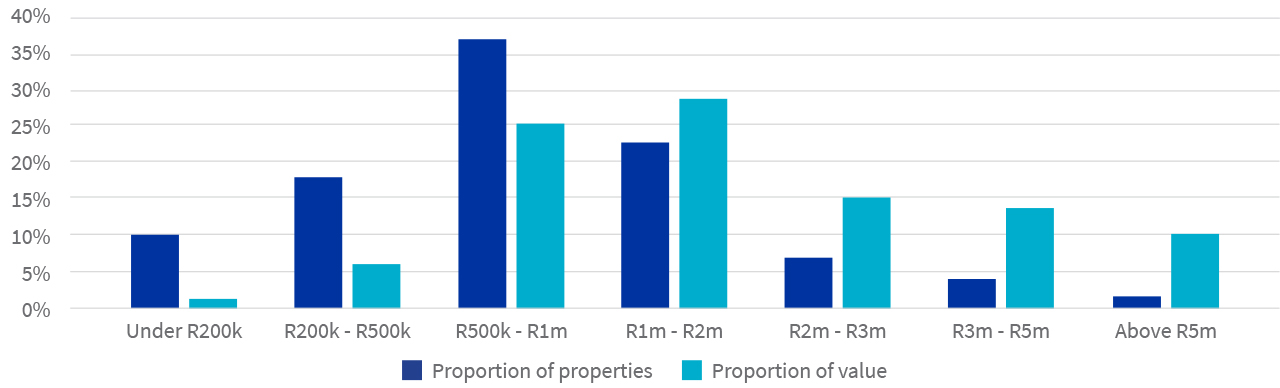

The single largest property band – with 35% of properties – is the R500k-R1m band but it represents only 25% of the stock value, while the R2m-R3m band represents only 5% of the properties but 15% of the stock value.

eThekweni residential property value bands

Durban, with nearly 150k properties, holds 31% of the volume and 34% of the value of properties in the municipality, while townships account for 21% of the volume but just 8% of the value.

Value of properties

Proportion of stock and stock value within areas

The highest average value suburbs in Durban are, in order of value, Durban North, Virginia, Glenashley and Athlone, where the average values are above R3m. The average value in Durban North is above R4m.

Of the high value suburbs, Virginia has recorded the highest value growth – 72% in the last 10 years, compared to around 50% in Durban North, Athlone and Glenashley.

On a less positive note, Durban Point has seen property values increase by only 8% in 10 years to its current average value of R2.4m.

There are 1 200 properties valued above R5m in Durban, and almost 7 000 valued above R3m.

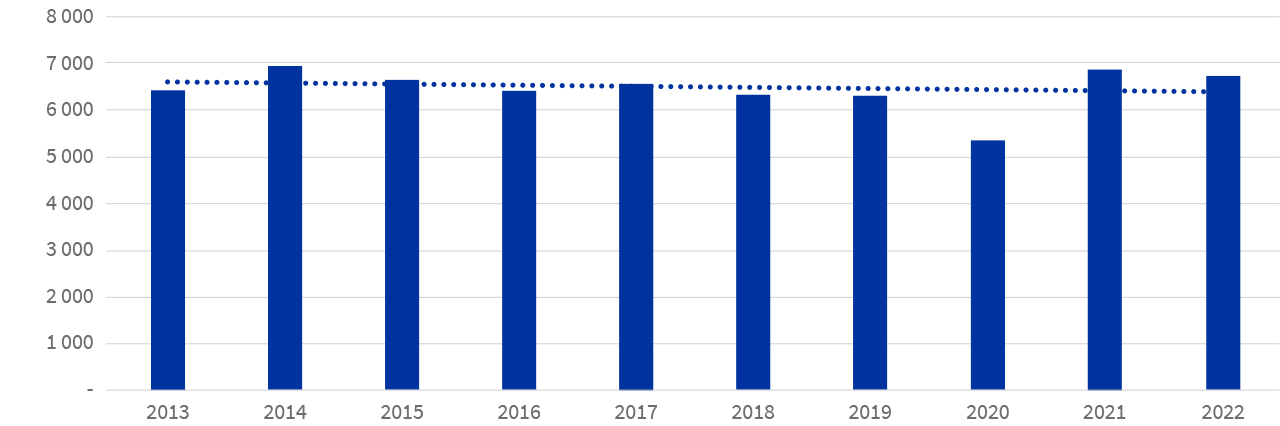

Sales in Durban

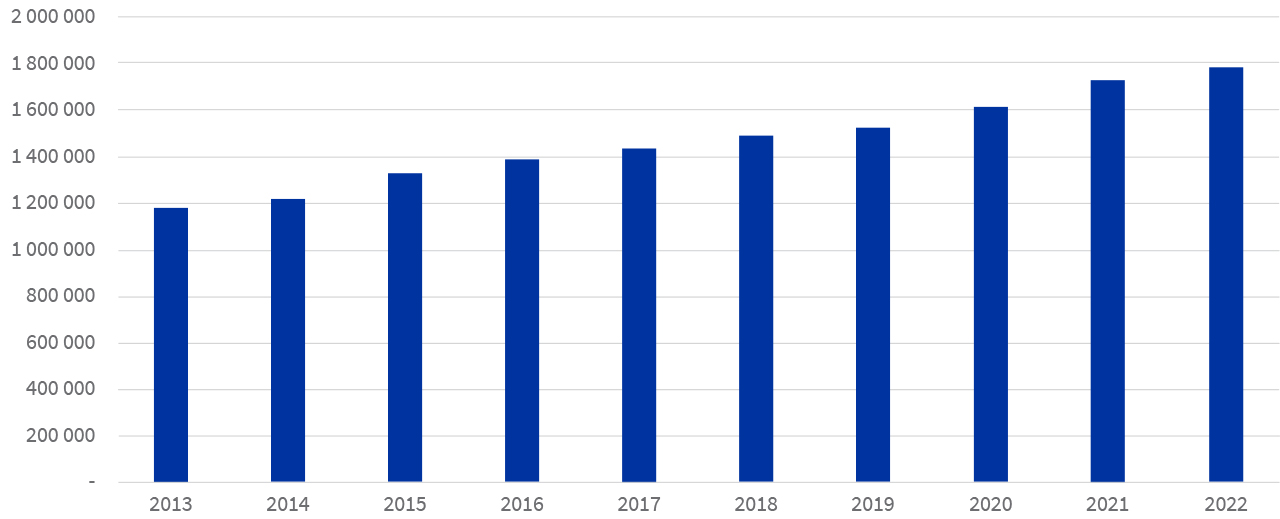

Sales volumes in Durban have tracked the national averages. Of the 6 700 sales which took place in 2022, 56% were under R1m and 32% between R1m – R2m.

Average sales prices have been increasing while volumes have moved consistently between 6 000 – 7 000 sales a year, other than 2020 when Covid-19 dampened the market.

Average sales price

Sales volume

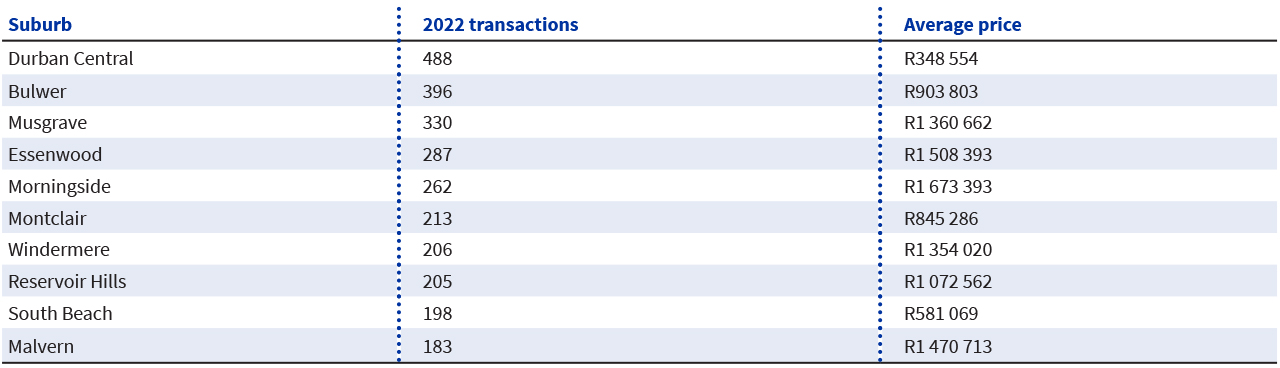

Durban Central recorded the most transactions in 2022, followed by Bulwer and Musgrave, although as the table below indicates, the highest average prices were found in Morningside and Essenwood.

Of the approximately 6 000 Sectional Scheme properties in Durban Central, almost 500 transacted in 2022, including a full scheme of 150 units purchased. About 50 of the remaining 350 properties were bought at values below their valuation 10 years ago, providing evidence of the challenges facing the Durban Central area.

The average value of Sectional Schemes in Durban Central delivered lower than average growth. The properties are currently valued at just 34% higher than recorded 10 years ago (R560k compared to R320k).

The average transaction value in 2022 for Sectional Scheme properties in Durban Central was R425k (excluding the purchase of all units in the Russel Mansion scheme). Some 9% of the units in the iconic John Ross House sold during 2022 at an average price of R466k, indicating value erosion in real terms as value increased by just 32% over 10 years.

Going north towards Umhlanga

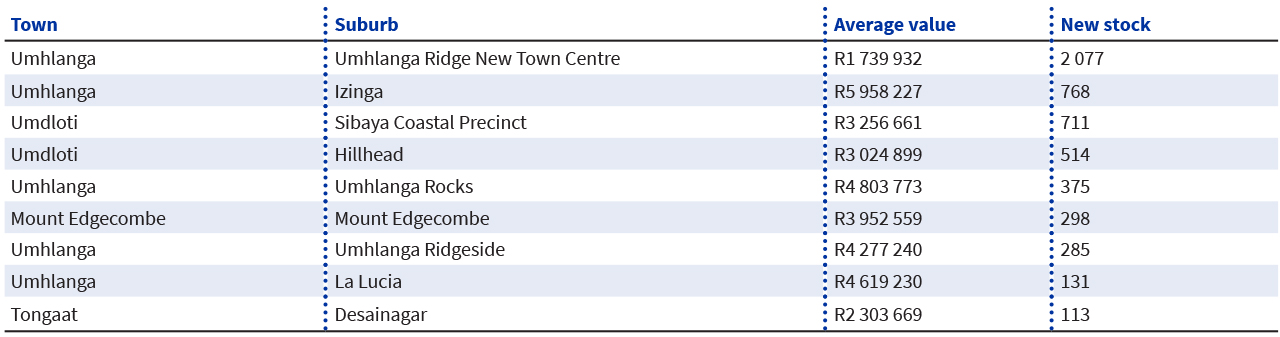

The area going north – including Umhlanga, Mount Edgecombe, Umdloti and Tongaat – recorded the highest stock growth in the metro in terms of units over the past 10 years, with 3 700 new units in Umhlanga and 1 300 in Umdloti. The balance was spread across the region.

The suburbs where the highest volume of stock was added, were:

Umdloti gained a third of its stock in the last year – which included the Sibaya Coastal Precinct, with a mix of residential, commercial and retail components – and Umhlanga gained 20% more stock over the past 10 years. As with most of the North Coast, accessibility to schools, shopping centres and the King Shaka International Airport have helped drive the rising value in the residential properties.

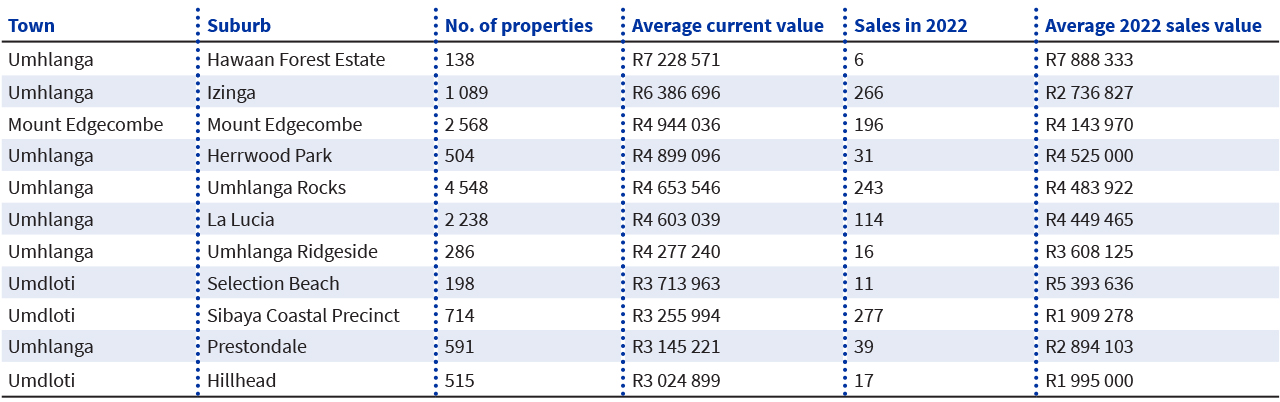

The highest value suburbs are:

The strength of the Umhlanga area is evident when analysing some of the data. Sales in Umhlanga totalled almost R4b in 2022, at an average of R2.8m per transaction. This contrasts with almost R1b recorded in Umdloti at an average of R2.1m and the total in Durban Central of R170m at an average of R350K.

There are 11 000 properties in the Umhlanga area valued at more than R3m (compared to 7 000 properties in Durban) and 4 400 properties valued at more than R5m, compared to 1 200 in Durban.

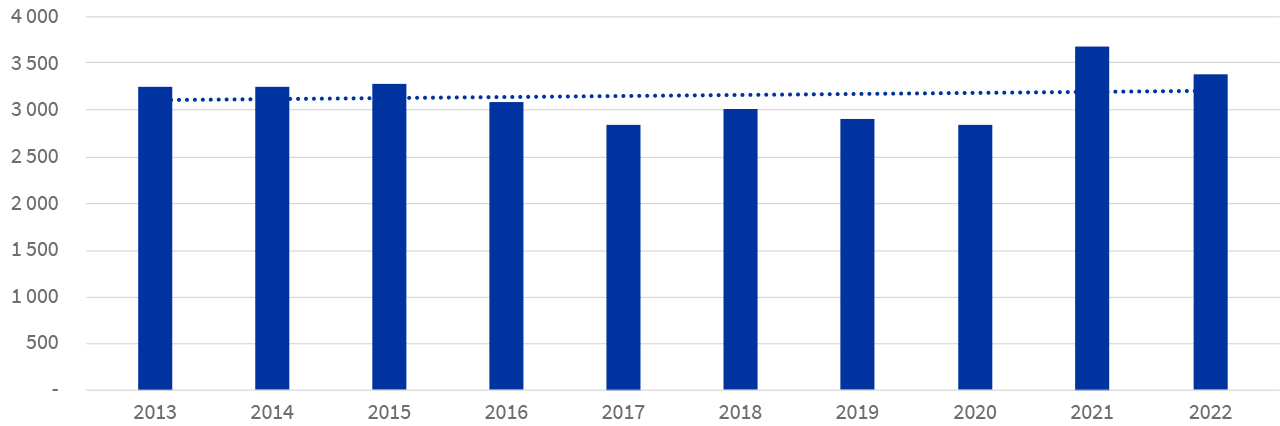

Sales also tell a different story, with volumes increasing from 2016 until Covid-19, as opposed to Durban where sales have been flat. Sales have recovered in 2022 and the trend line should move upwards if current pattens continue.

Towards Umhlanga: sales transactions

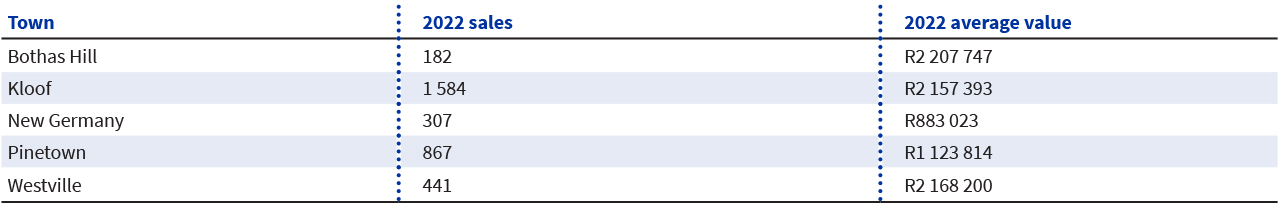

North-east towards Hillcrest and Kloof

The north-eastern areas, which include Botha’s Hill, New Germany, Hillcrest, Kloof, Pinetown and Westville, saw stock growth of just 5% in the last 10 years, compared to 22% in the broader Umhlanga area.

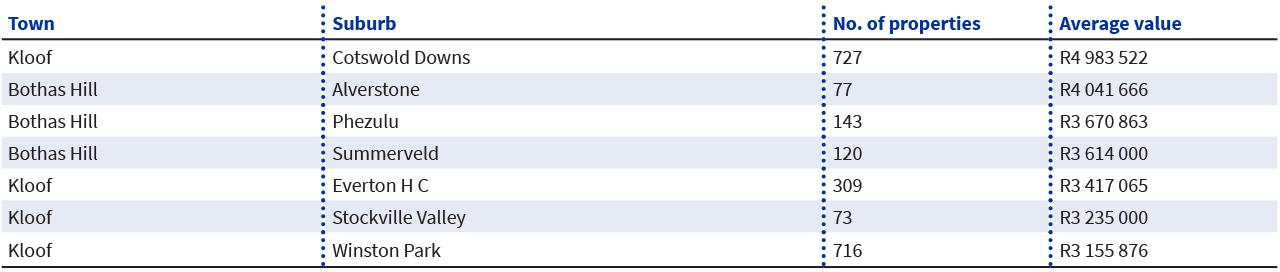

The highest value suburbs include:

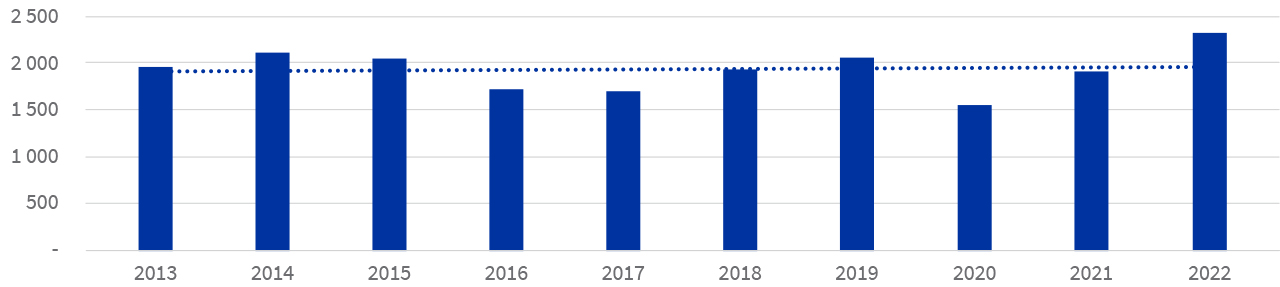

Sales transactions improved significantly in 2021, while the average value of transactions has been increasing steadily over the past 10 years.

Sales transactions

Average transactions value

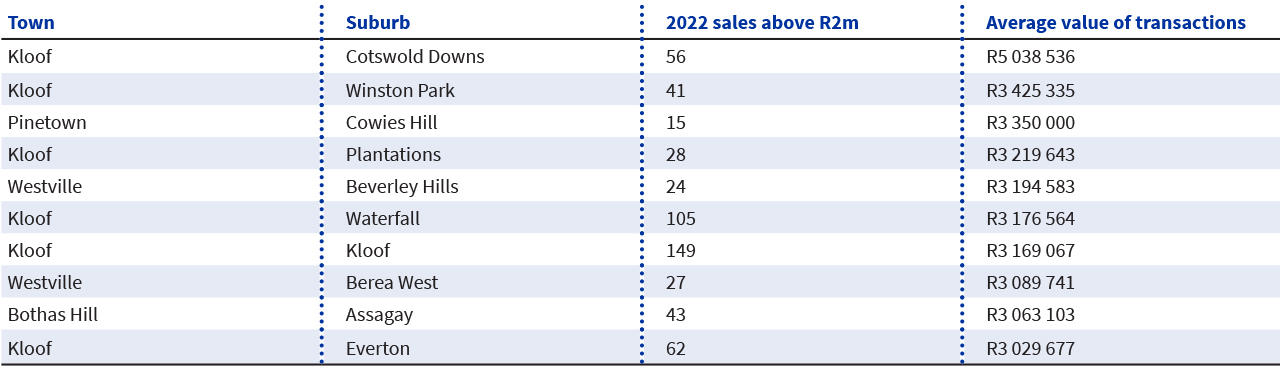

Kloof led sales in the area, with 7% of properties transacting at an average value of over R2m.

Suburbs with a significant number of sales in 2022 (more than 20) with values higher than R2m were:

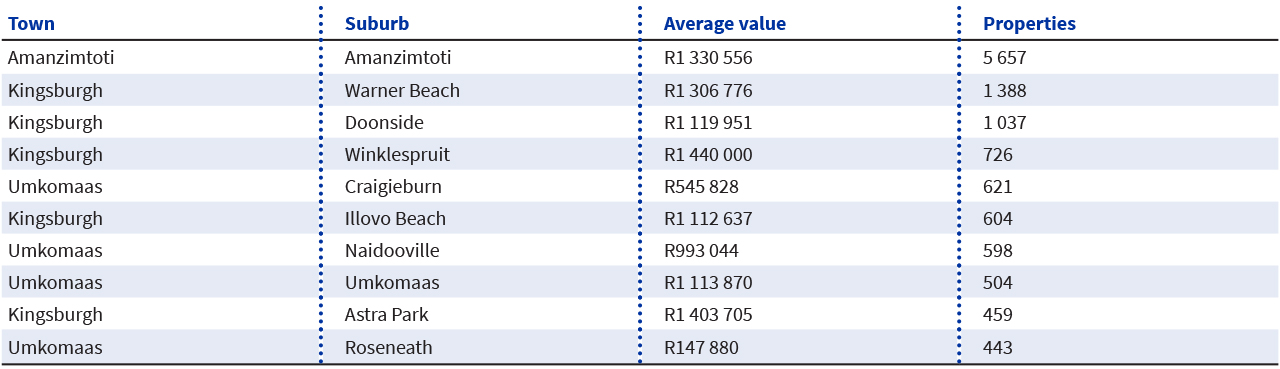

Going south

There were just 1 600 new units added to the residential property stock in the area towards Amanzimtoti, in contrast to 6 000 in the Umhlanga area.

More significantly, the growth in value (47%) has been lower than any other area in eThwekeni – Durban’s value grew by 50%, towards Hillcrest by 61%, and towards Umhlanga by 55%.

There were just 10 properties valued above R5m (total value of R90m) which transacted during 2022 in the area, and only 105 over R2m at a total value of R343m.

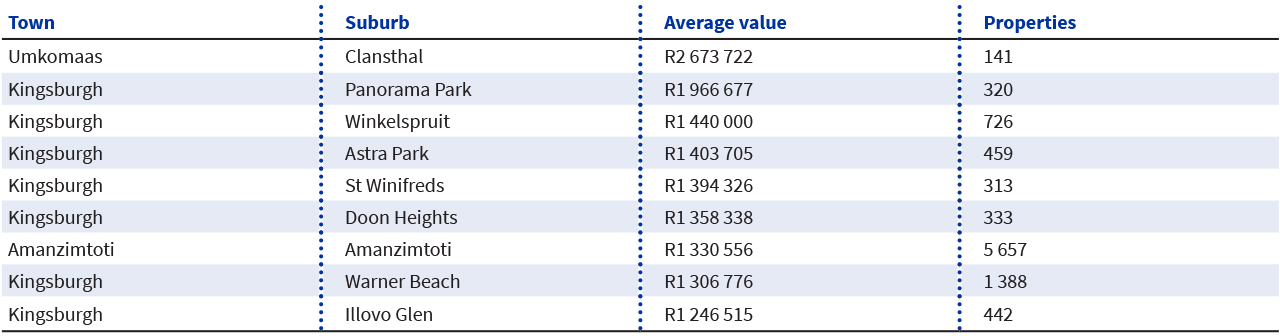

The area’s best performer in terms of value growth was Panorama Park in Kingsburgh.

Biggest suburbs

Highest value suburbs

.png)

.png)

.png)

.png)