Property Newsletter | October 2022

SA residential property facing headwinds to move forward

Volumes in holding pattern while Mid value property price inflation is just off the all-time high of 2020

After bouncing back positively from Covid-19, South Africa’s residential property is now facing domestic and global headwinds.

At home, rising interest rates, socio-political tensions and a limp economy bedevilled by intermittent power dampen consumer spirits, while abroad the Russian invasion of Ukraine and numerous other geo-political hotspots are unsettling global stability.

And despite all these factors, South Africa’s residential property is showing pockets of progress and opportunity.

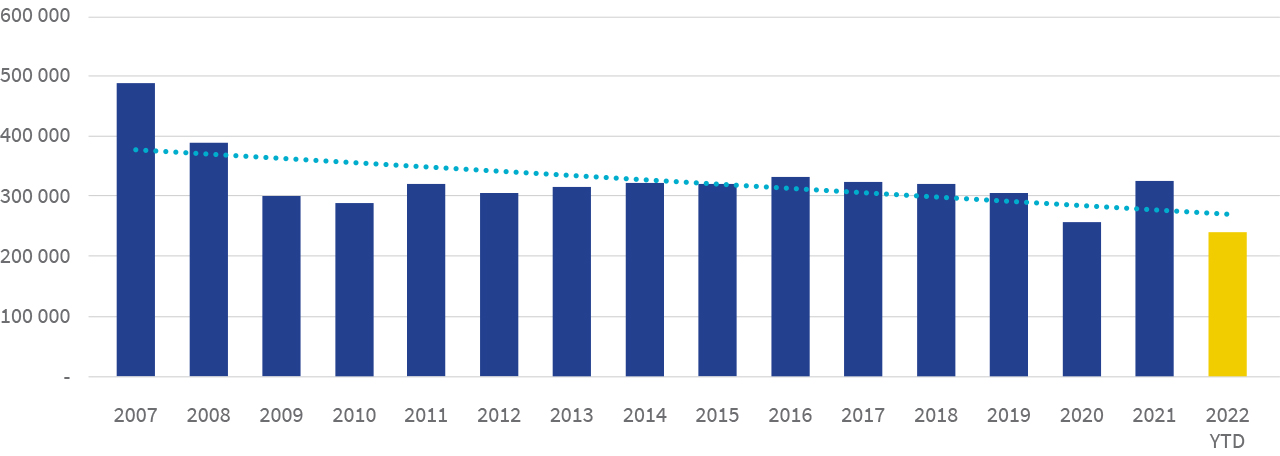

Overall transfer volumes are continuing their uneven trajectory, with 2022 anticipated to reach around 330 000, well down from the high of 493 000 recorded just prior to the 2008 crash.

However, if sales do hit 330 000, it will match the 2021 Covid-19 bounce-back from 263 000 and similar volumes last recorded in 2017 and 2018.

Transfer volumes

Who is buying?

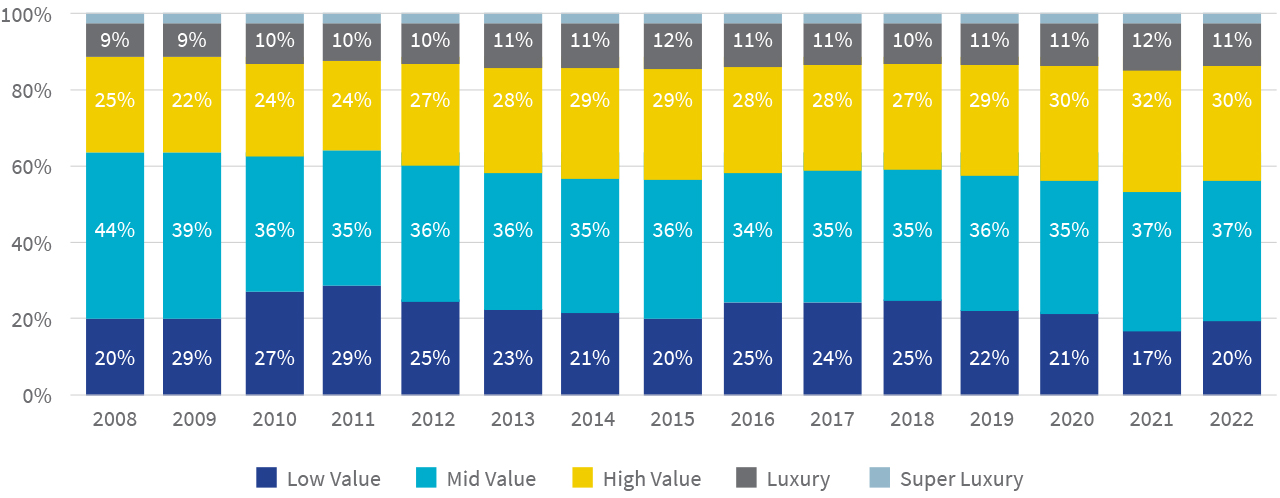

If volumes are falling or flat, then who are the buyers?

As the graph below shows, buyers were predominatly from the Mid value (37%) and High value (32%) segments in 2021, which has been a consistent trend for many years. In fact, the Mid value share of market was at its highest since 2009, and looks to be holding the same level in 2022.

Luxury category buyers were back to 12% in 2021, the highest recorded in this category and last matched in 2015, and buyers in the High category hit 32% in 2021, the highest score recorded in the past 14 years.

Unfortunately, Low value buyers dropped below 20% in 2021, suggesting perhaps less new entrants into the market – an unwelcome development given the country’s demographics – with market activity dominated by the Mid and High values.

Transfer values

Property price inflation

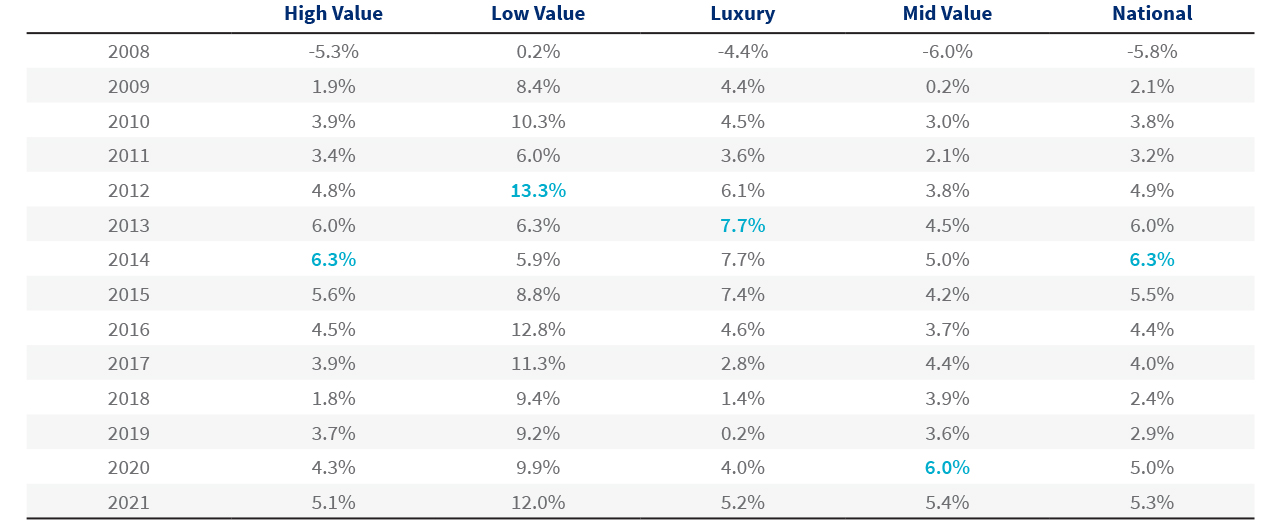

However, despite sales in the Low value category trailing Mid value and High value, property price inflation is most pronounced in this category, except for a dip in 2013 and 2014.

In fact, Low value property price inflation in 2021 was 12%, more than double High value (5.1%), Luxury (5.2%) and Mid value (5.4%), and more than double the national average of 5.3%. In fact, Low value property price inflation has been over 9% since 2016.

While the Low value properties have seen prices rise, the Luxury category has fallen the most, coming off a high in 2014 of 7.7% and dropping to 5.2% in 2021. High value properties also peaked in 2014 at 6.3%, and in 2021 were 5.1%, while Mid value prices had their best year in 2020 (6.0%), dropping to 5.4% in 2021.

Property price inflation by value band

The years 2012 to 2014 (highlighted in the table above) were the best in terms of property price inflation since 2008, with High value (2014), Low value (2012), Luxury (2014) and the national average (2014) recording their 24-year highs. Only the Mid value band recorded its best year outside 2012-2014 – and that was in the Covid-19 bounce back year of 2020.

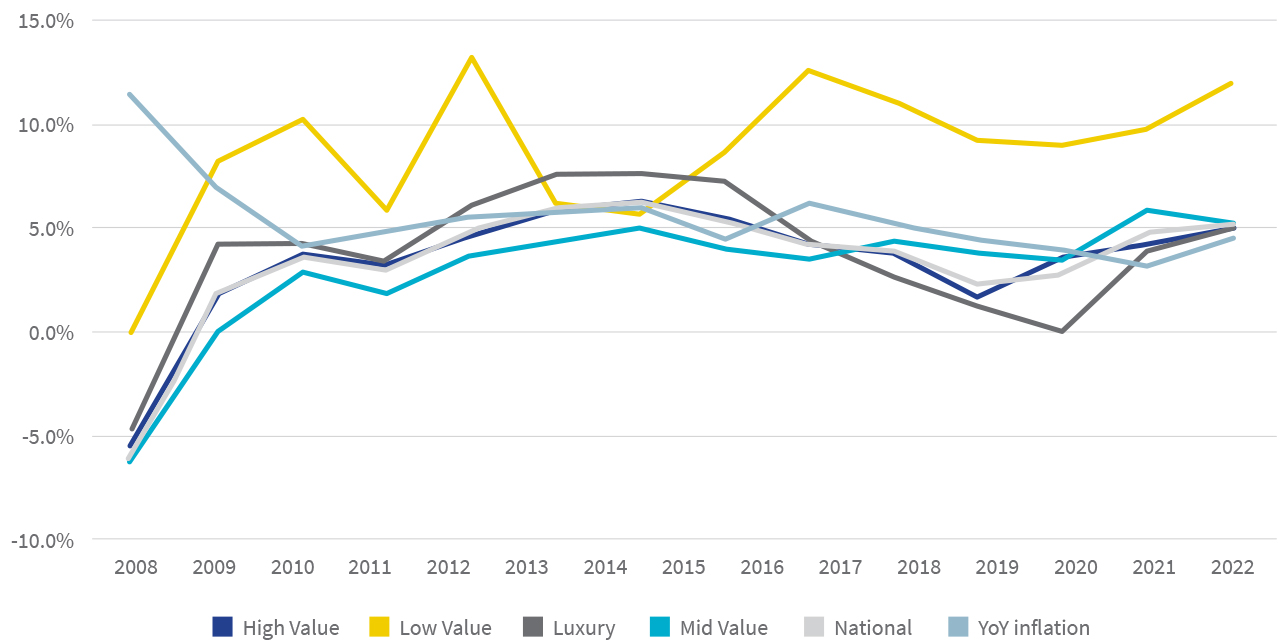

Other than 2014 being a “golden year” for rising property inflation, the table above and graph below indicate the hugely inconsistent movements in property price inflation, both within the property segments and collectively.

When Property Price Inflation is superimposed on the CPI (see graph below) over the years 2008 to 2021, all of the property value bands have outperformed the CPI since 2020.

Property price inflation and CPI YoY: 2008 - 2021

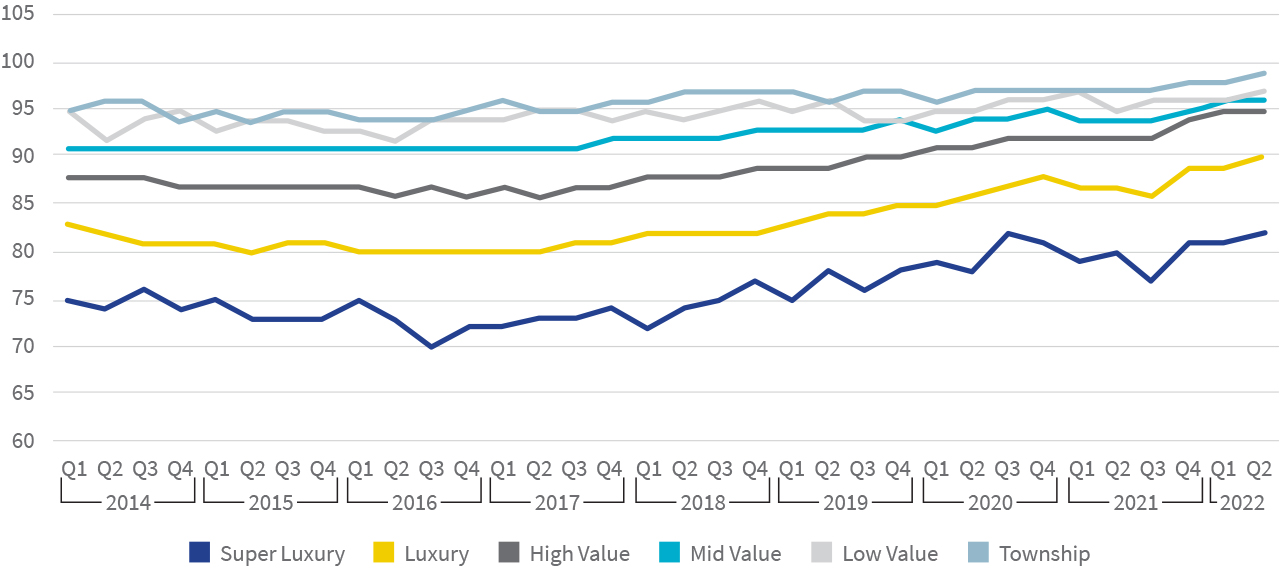

Loan to value increasing

Banks are offering higher loan-to-value (LTV), helping to stretch affordability of home ownership. We can also see property owners holding onto their properties for longer. The LTV of all segments is on the rise as the graph below shows, but this is especially true of the High value segment.

Average LTV by value band

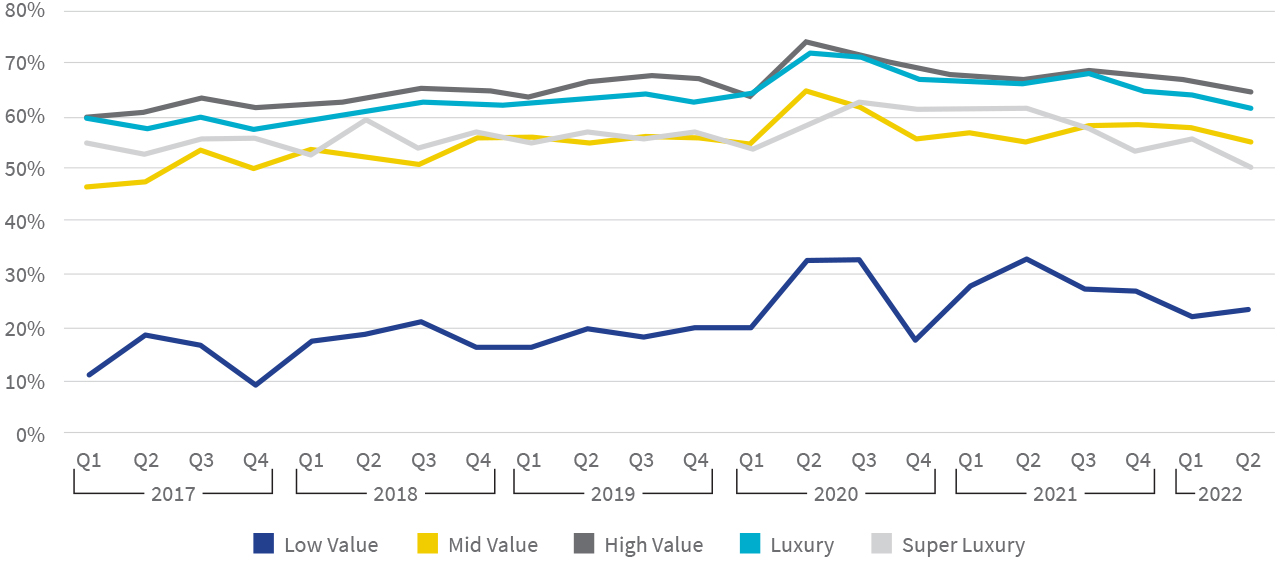

Bond penetration stepped up for all segments in 2020 Q2.

% Bond penetration by value band

.png)

.png)

.png)

.png)