Auto Insights Newsletter | February 2024

Crossover/SUV in top position for three consecutive years

Consumer preferences for Light Vehicle bodyshapes have shifted over the last five years, with sales of the Crossover/SUV segment overtaking the perennial king of the local market, the Hatchback.

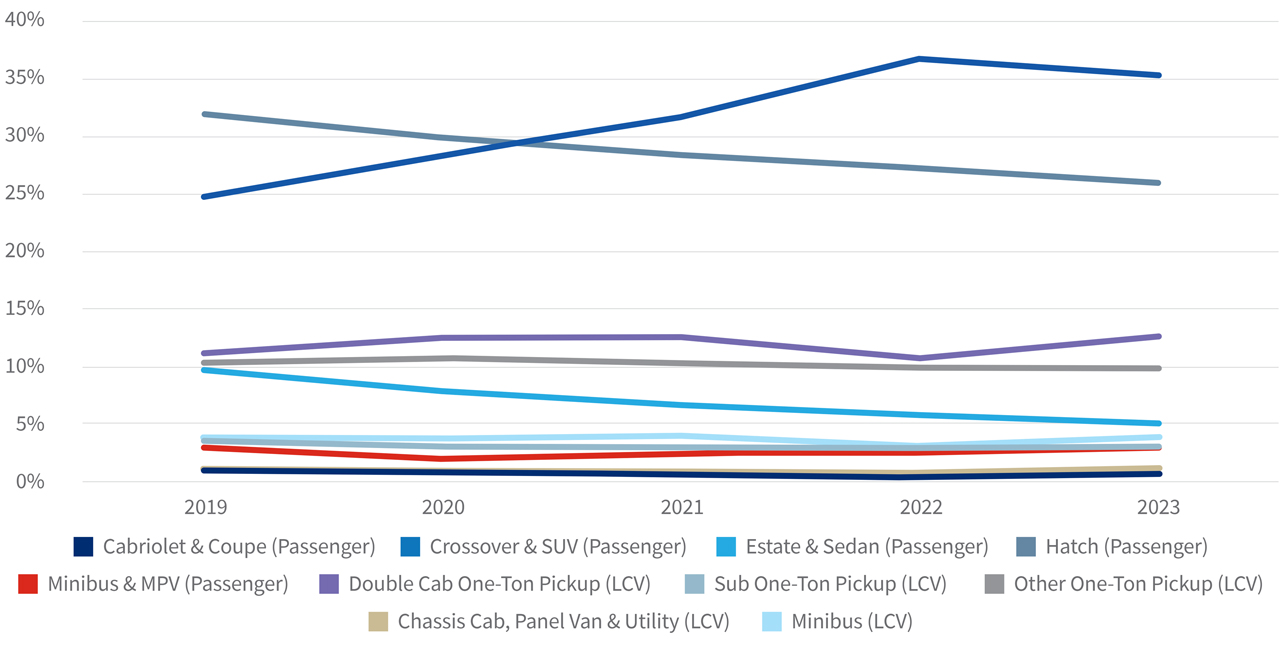

Light Vehicle market share by bodyshape - 2019 to 2023

In 2019, the Crossover/SUV bodyshape, with its higher driving position, perceived levels of improved safety and better ride height on local roads, made up 25% of all Light Vehicle sales in the South African market. At the time the forerunners in the segment were Toyota’s Fortuner and RAV along with the Ford EcoSport. This was still some way behind the Hatch’s 32% market share as the VW Polo and Polo Vivo, along with Renault Kwid, helped in maintaining the spot for the Hatch at number one.

By 2021, however, the roles had been reversed, as the Crossover/SUV segment broke through the 30% share barrier for the first time to reach 32% and consigned the Hatch to second place with 28%.

Fast-forward to 2023, and the Crossover/SUV bodyshape, now buoyed by the likes of the Toyota Corolla Cross, Toyota Fortuner and Chery Tiggo 4 Pro, celebrated a second successive year with a share above 35%. However, the Hatch segment, with the Polo Vivo now being joined by the Suzuki Swift and Toyota Starlet as the biggest sellers, while still in second place, has continued to see its market share drop, ending last year on 26%.

Interestingly the next three segments have seen no change in their positions over the last five years, with the One-Ton Double-Cab (third – Ford Ranger, Toyota Hilux, Isuzu D-Max) , One-Ton Single/Extended Cabs (fourth – Toyota Hilux, Isuzu D-Max, Mahindra Scorpio Pik-Up) and the Estate/Sedan grouping (fifth – Toyota Corolla Quest, VW Polo Sedan, Suzuki Dzire) holding constant. However, while the Double-Cab has seen its share grow from 11% in 2019 to 13% in 2023, and the other One-Tons have held pretty steady around the 10% mark, the Estate/Sedan bodyshape has continued to struggle, sliding from a 10% share in 2019 to 5% in 2023.

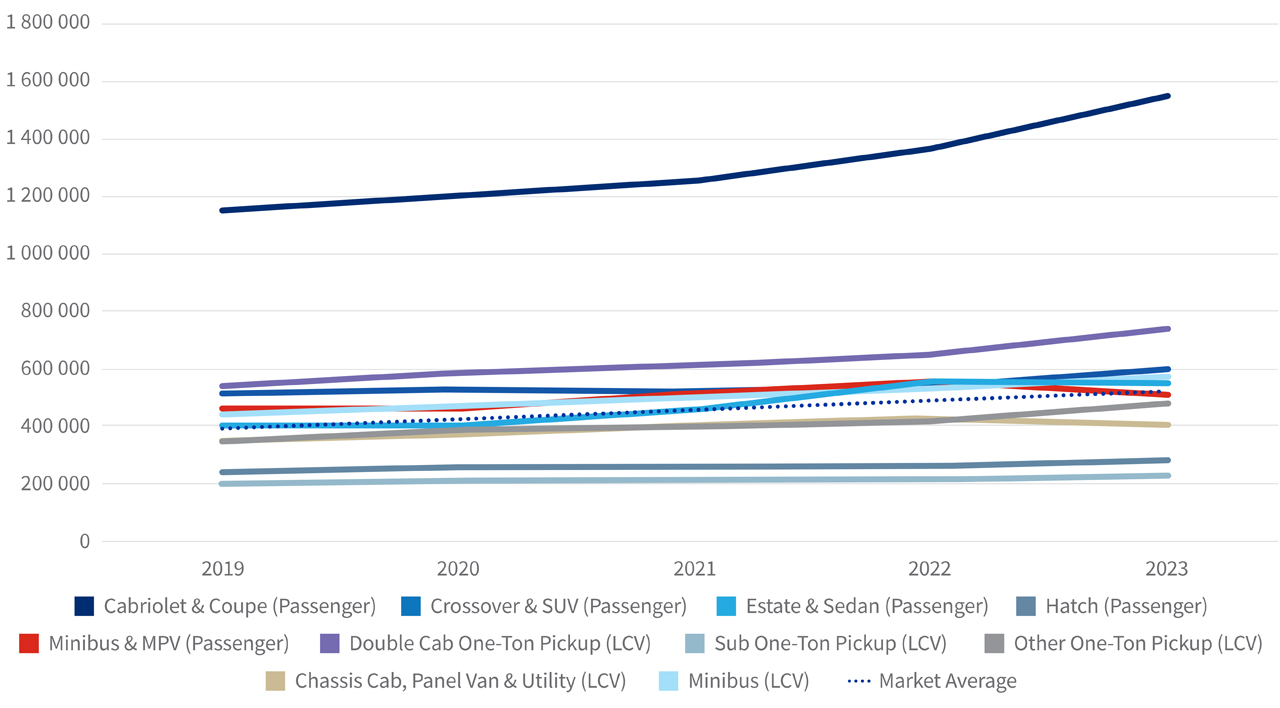

Light Vehicle bodyshape Weighted Average Price in Rand - 2019 to 2023

The relative price points of these bodyshapes, using the Weighted Average Price (WAP) in Rand for each segment, reveals that just two from 10 have “crossed over” the market average over the past five years. In 2019 the WAP of the Light Vehicle market was R397 000, and by 2023 this had climbed to R519 000.

The Half-Ton Pick-Up bodyshape, controlled by the soon-to-be retired Nissan NP200, has a WAP around half that of the market average (WAP still under R235 000), and the Hatch, which still dominates the Entry segment in terms of offerings, is just ahead (2023 WAP = R287 000). Those bodyshapes running closest to the market WAP are the Estate/Sedan (2023 WAP = R553 000) and the Other One-Ton Pick-Up collection (2023 WAP = R482 000).

At the top end of the price scale are the Double-Cabs, which have seen their WAP jump from R543 000 in 2019 to R735 000 in 2023. These prices are well short, though, when compared to the WAP of the Cabriolet/Coupe segment. Some of the better performing vehicles in this grouping currently include the BMW 2 and 4 Series Coupes and the Ford Mustang. In 2019, the WAP of this bodyshape was R1.15 million, and subsequently reached R1.5 million in 2023!

.png)

.png)

.png)

.png)