Auto Insights Newsletter | April 2023

Affordability drives Light Vehicle sales rankings

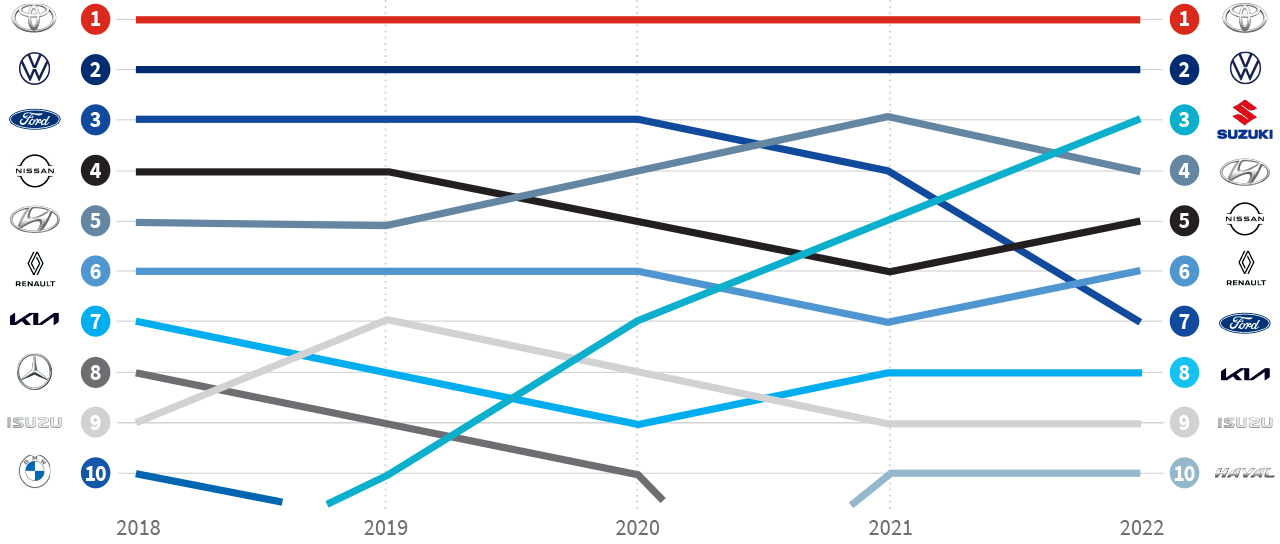

Affordability appears to be driving new Light Vehicle (LV) sales, and the absence of a premium brand in South Africa’s Top 10 sellers underlines this reality.

Premium brands BMW and Mercedes-Benz have both exited the Top 10 in recent years – BMW in 2019 and Mercedes-Benz in 2021 – while high-volume marques Suzuki is now in third position – just four years after entering the Top 10.

Toyota and Volkswagen have occupied first and second positions for the past five years, while affordability has been a key brand feature behind Suzuki’s remarkable rise from 10th in 2019 to 3rd in 2022 – the weighted average price of a Suzuki in 2022 was a little more than half that of the LV market as a whole.

The Top 10 Light Vehicle brands, in order of popularity in 2022, were:

Light Vehicle brand ranking: new vehicle sales

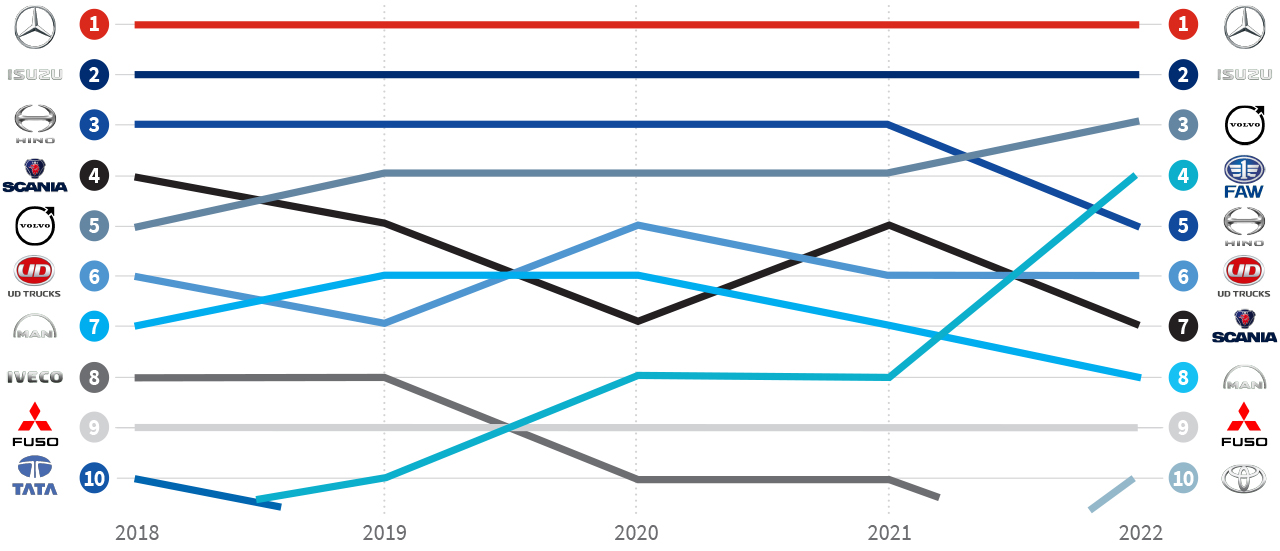

Mercedes-Benz and Isuzu have held the first and second positions in the other Commercial Vehicle (CV) brand rankings over the last five years, and in 2022 were followed by Volvo Trucks, which had jumped from 5th in 2021 to 3rd. Toyota broke into the Top 10 in 2021 with their Medium Commercial Bus offering, while Scania has dropped from 4th in 2018 to 7th in 2022.

The Top 10 other CV brands, in order of popularity in 2022, were:

Other Commercial brand ranking: new vehicle sales

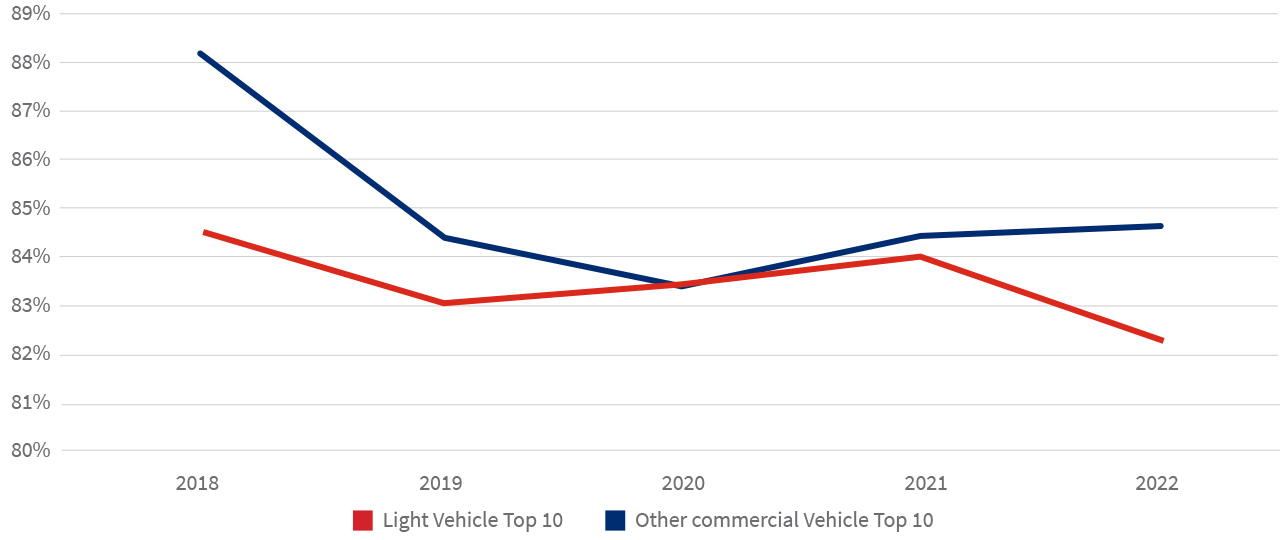

The Top 10 Light Vehicle brands usually account for between 80% and 85% of the LV market, while the combined market share of the Top 10 brands for the other Commercial Vehicles has been between 80% and 90%.

Top 10 combined share of market

.png)

.png)

.png)

.png)